putnam county property tax rate

The median property tax in Putnam County Georgia is 747 per year for a home worth the median value of 157600. The median property tax in Putnam County Ohio is 1379 per year for a home worth the median value of 130200.

Putnam County Tax Collector Honorable Linda Myers

A property tax calculator is available to estimate the property tax due for any appraised value.

. In Florida Property Appraisers are independent constitutional. What is the property tax rate in Putnam County NY. Putnam County collects on average 074 of a propertys assessed fair.

Yearly median tax in Putnam County. 106 of home value. Putnam County collects on average 175 of a propertys.

Changes occur daily to the content. Putnam County Property Tax Facts. Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204.

Putnam County collects on average 057 of a propertys assessed. The median property tax in Putnam County Indiana is 938 per year for a home worth the median value of 119800. The median property tax in Putnam County Florida is 813 per year for a home worth the median value of 109300.

The median property tax also known as real estate tax in Putnam County is 81300 per year based on a median home value of 10930000 and a median effective property tax rate of. Who sets the county tax rate and when. Putnam County collects on average 064 of a propertys.

The median property tax in Putnam County West Virginia is 776 per year for a home worth the median value of 135200. The 2022 City of Cookeville Property Tax Rate is 082 per 100 of assessed value. With our guide you will learn important facts about Putnam County property taxes and get a better understanding of things to plan for when it is time to pay the bill.

Putnam County Property Appraiser. The median property tax in Putnam County New York is 7331 per year for a home worth the median value of 418100. The Putnam County Commission sets.

Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. Official Putnam County Illinois website features interactive maps for economic development government minutes agendas county departments. If you are presently.

What is the Putnam County tax rate. Putnam Country Tax Assessors Office Website. Taxes must be paid by.

Instead contact this office by phone or in writing. The accuracy of the information provided on this website is not guaranteed for legal purposes. Hitchcocks Shopping Center 1114 State Rd 20 Suite 2 Interlachen FL 32148 386-329-0282.

The 2022 county tax rate is 2472 10000 2472 assessed value. Putnam County collects on average 078 of a propertys assessed fair. Sheriff Bobby Eggleton Bobby Eggleton is one of the most experienced law enforcement officers in Putnam County.

Putnam County collects on average 047 of a propertys assessed fair. The median property tax in Putnam County Tennessee is 797 per year for a home worth the median value of 124000.

Tax Division Putnam County Sheriff

Notice Of Property Tax Increase Putnam County Georgia

Putnam County Property Tax Inquiry

Taxes The Treasurer Village Of Pinckney

Putnam County Commissioners Pass Resolution Supporting Passage Of Amendment 2 Wchs

Putnam County Ny Property Tax Search And Records Propertyshark

Atlanta School Board Adopts Property Tax Rate

2022 Best Places To Buy A House In Putnam County Ny Niche

New York City Property Tax Rate Is It Worth Selling

Tax Services Putnam County Tax Collector

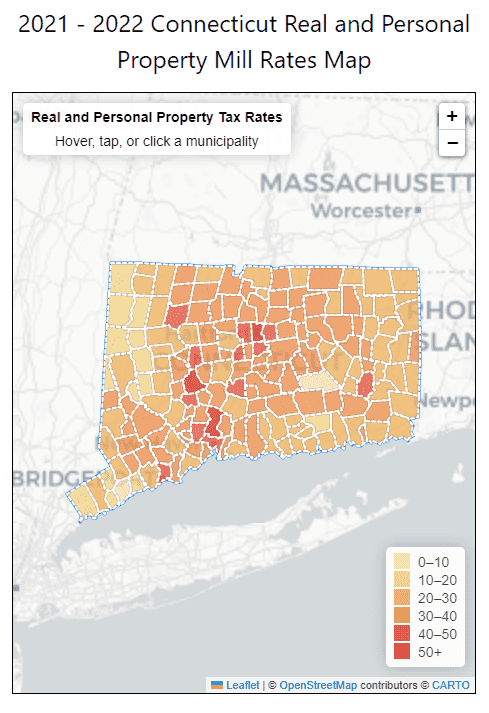

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

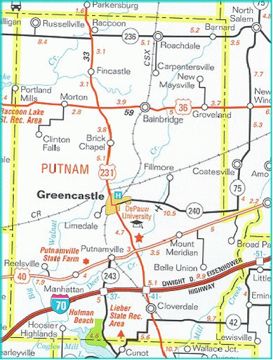

Greencastle Putnam County Development Center Greencastle Community Resume

Putnam County Ny Property Tax Search And Records Propertyshark

Florida Property Tax H R Block

Property Tax By County Property Tax Calculator Rethority

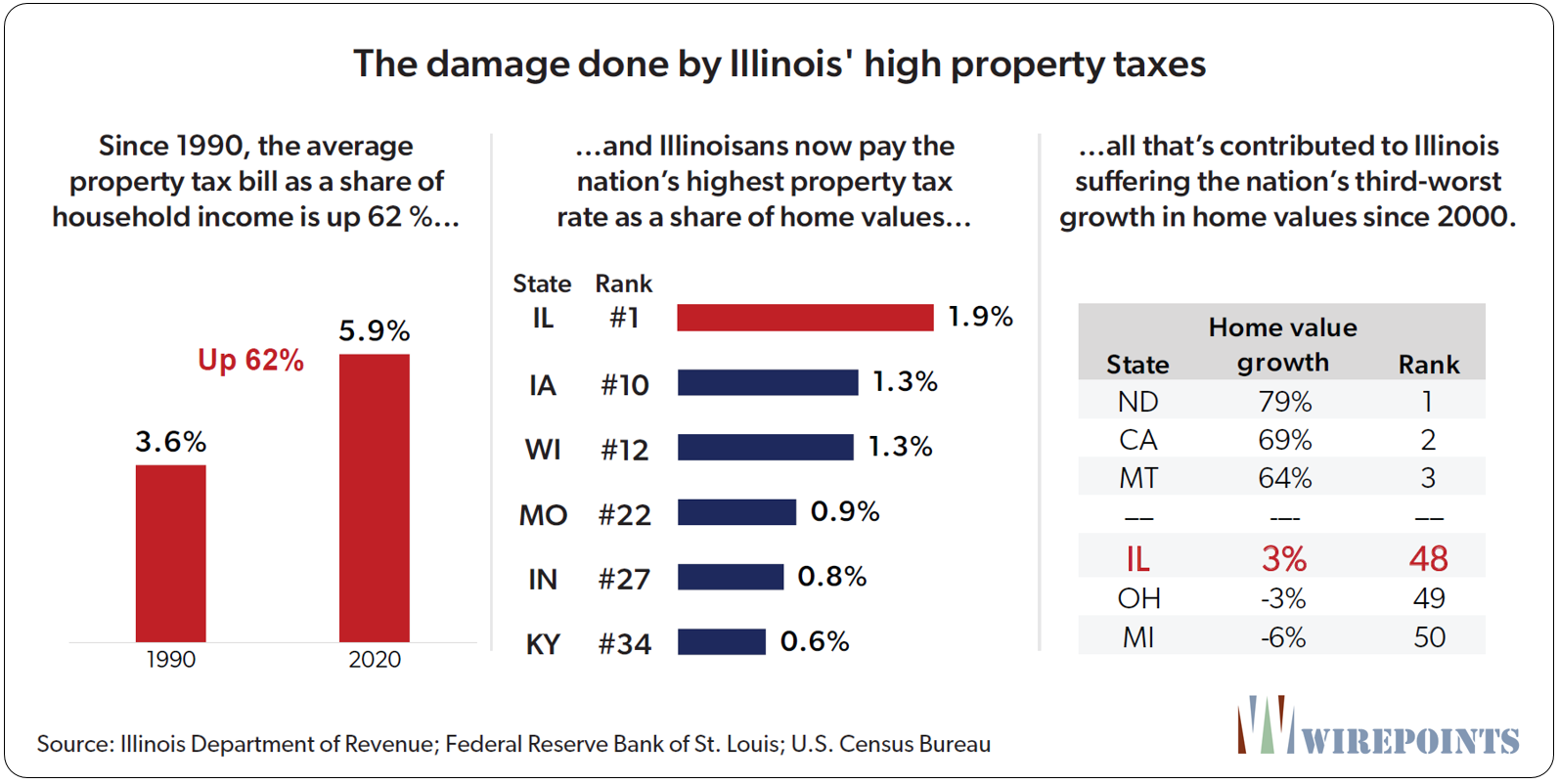

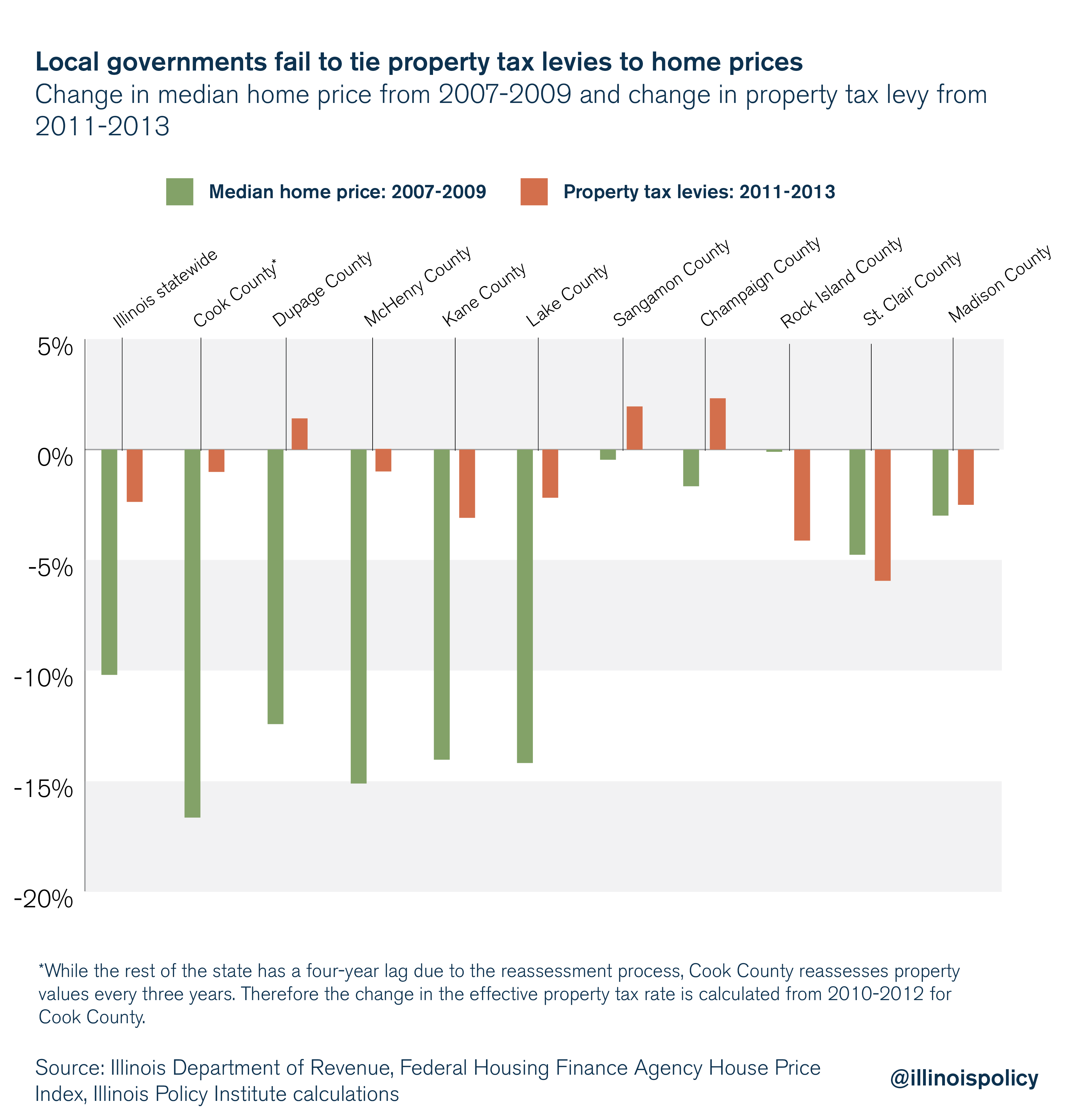

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

When Illinois Home Values Fall But Property Taxes Don T Illinois Policy